What is EUR/GBP?

The EUR/GBP currency pair measures the value of the Euro (EUR) relative to the British Pound Sterling (GBP), with the Euro representing the collective economies of Eurozone countries and the Pound representing the British economy. As a minor currency pair, EUR/GBP has less liquidity compared to major pairs involving the US dollar, such as EUR/USD or GBP/USD, which results in wider spreads with forex brokers. The pair was established on January 1, 1999, coinciding with the Euro’s introduction as a digital currency, and physical Euro banknotes and coins were introduced on January 1, 2002.

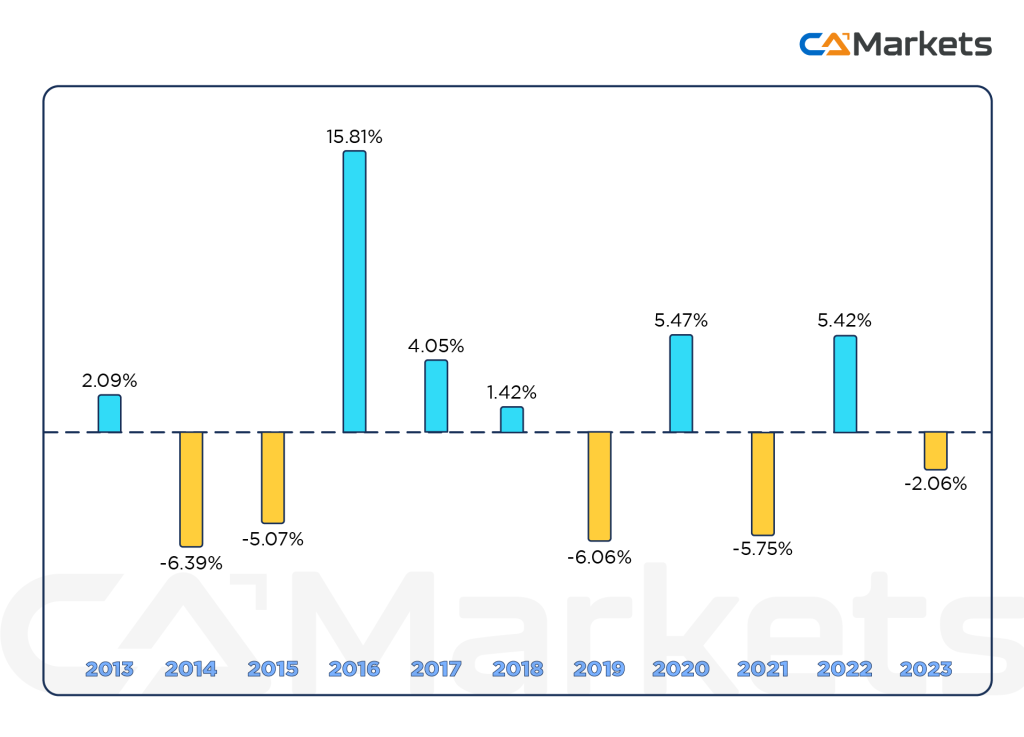

EUR/GBP Historical Performance

The historical performance of the EUR/GBP currency pair reflects various economic, political, and financial factors that have influenced the Euro and the British Pound over time. Here’s a general overview of the key trends and events affecting the EUR/GBP pair:

1. Pre-Euro Era (Before 1999):

- Historical Context: Before the Euro was introduced, the GBP/EUR (inverted) would reflect the relative value of the British Pound against the currencies of Eurozone countries, including the Deutsche Mark and French Franc.

2. Post-Euro Introduction (1999-2008):

- Early Years: Following the Euro’s introduction as a digital currency in 1999, the EUR/GBP exchange rate showed considerable volatility as markets adjusted to the new currency. The pair generally experienced periods of fluctuation driven by economic performance and market sentiment.

3. Global Financial Crisis (2008-2010):

- Impact: The financial crisis led to significant movements in the EUR/GBP pair. The GBP weakened against the Euro during the crisis due to the severe impact on the UK economy and financial sector.

4. Post-Crisis Recovery (2010-2015):

- Recovery and Volatility: The pair continued to experience volatility as both the Eurozone and the UK navigated recovery from the crisis. Economic data, monetary policy decisions, and geopolitical events played a key role in influencing the exchange rate.

5. Brexit and Its Aftermath (2016-2020):

- Brexit Referendum: The 2016 Brexit referendum and subsequent political and economic uncertainty surrounding the UK’s departure from the EU caused significant fluctuations in the EUR/GBP pair. The GBP generally weakened against the Euro as concerns about the economic impact of Brexit grew.

- Trade Negotiations: Ongoing trade negotiations and updates on Brexit-related developments continued to affect the EUR/GBP exchange rate, with periodic volatility.

6. COVID-19 Pandemic (2020-2022):

- Pandemic Impact: The COVID-19 pandemic led to further economic uncertainty, impacting both the Eurozone and the UK. The EUR/GBP exchange rate experienced fluctuations based on economic stimulus measures, pandemic management, and market sentiment.

7. Recent Trends (2022-Present):

- Post-Pandemic Adjustments: As economies adjusted post-pandemic, the EUR/GBP pair has continued to reflect changes in economic indicators, monetary policies, and geopolitical developments. Inflation, interest rates, and economic growth in both regions remain key factors.

Factors influencing EUR/GBP

The EUR/GBP currency pair, which represents the exchange rate between the Euro and the British Pound, is influenced by a variety of key factors:

1. Interest Rates:

- European Central Bank (ECB) and Bank of England (BoE): Interest rate decisions by the ECB and BoE significantly impact the EUR/GBP rate. When the ECB cuts rates, it generally weakens the Euro relative to the Pound, making the EUR/GBP rate higher. Conversely, when the BoE cuts rates, the Pound typically weakens, causing the EUR/GBP rate to fall. Interest rates are crucial as they reflect economic stability and inflation expectations.

2. Economic Data:

- Economic Indicators: Data such as GDP growth, unemployment rates, and consumer price indices from both the Eurozone and the UK affect the EUR/GBP pair. Strong economic data from the Eurozone can boost the Euro, while robust data from the UK can strengthen the Pound.

3. Political Events:

- Political Stability and Policy: Political events, particularly those related to Brexit, have created significant volatility in the EUR/GBP market. Political instability or major policy changes in either the Eurozone or the UK can lead to fluctuations in the exchange rate.

4. Role of the Euro:

- History and Impact: The Euro was launched on January 1, 1999, and became a physical currency on January 1, 2002. Its introduction aimed to facilitate trade and economic stability across the Eurozone. However, the Eurozone’s one-size-fits-all monetary policy can be challenging for countries with varying economic conditions.

5. Role of the British Pound:

- Historical Significance: The British Pound, one of the oldest currencies, is a major global reserve currency, reflecting the UK’s historical economic and financial influence. London’s status as a global financial center further supports the Pound’s value. Investment flows into the UK and economic performance play key roles in determining the Pound’s strength.

6. Trading Strategies:

- Technical and Fundamental Analysis: Trading strategies for EUR/GBP can include short-term scalping, swing trading based on medium to long-term trends, and analysis of technical indicators and economic data. Decisions to buy or sell EUR/GBP should be based on expectations of economic conditions and market sentiment towards the Pound and the Euro.