CA Markets: June Holiday Trading Schedule

Warm greetings from all of us at CA Markets! As we usher in the month of June, we want to take a moment to extend our sincerest wishes for your continued health, happiness, and success. Adjusted Trading Hours for June Holidays In observance of the upcoming June holidays, please find below the adjusted trading hours […]

US Dow Jones 30 CFD Trading: Dow Jones Industrial Average Index (US30)

The DJIA, also known as the Dow, US30 or DJ30, holds significant stature as a market index tracking the top 30 publicly traded blue-chip companies in the United States. Created by Charles Dow and Edward Jones, it stands as the second-oldest US market index, following the Dow Jones Transportation Average.

CA Markets: May Holiday Trading Schedule

Warm greetings from all of us at CA Markets! As we usher in the month of May, we want to take a moment to extend our sincerest wishes for your continued health, happiness, and success. Adjusted Trading Hours for May Holidays In observance of the upcoming May holidays, please find below the adjusted trading hours […]

US S&P 500 CFD Trading: Standard & Poor’s 500 Index (SPX500)

The S&P 500, often referred to simply as the S&P or the Standard & Poor’s 500, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

US Nasdaq 100 CFD Trading: NDX (NAS100)

The NAS100 index, also known as the NASDAQ-100 index, is a stock market index that includes 100 of the largest non-financial companies listed on the NASDAQ stock exchange. It represents a diverse array of industries, primarily focusing on technology, telecommunications, retail, biotechnology, media, and transportation sectors.

What are rollover and swap in forex trading

A forex swap fee, also known as rollover or overnight interest, is the cost or reward associated with holding a forex position overnight. It reflects the interest rate differential between the two currencies in a currency pair being traded.

Understanding of Oil CFDs trading

Oil CFDs (Contracts for Difference) are financial derivatives allowing traders to speculate on oil price movements without owning the underlying asset. Traders can take long (buy) or short (sell) positions, profiting from price changes. CFDs operate with leverage, enabling traders to control larger positions with a fraction of the capital.

Understanding why gold volatility is higher than forex

Both gold and forex can experience volatility, gold typically exhibits higher volatility due to its smaller market size, sensitivity to macroeconomic events, and role as a safe-haven asset. Forex markets, due to their sheer size and diverse participant base, often show more stable and predictable price movements in comparison.

How can you trade or invest in gold

Investing in and trading gold can be approached in several ways, depending on your financial goals, risk tolerance, and investment horizon. Here are some common methods and strategies for investing and trading in gold.

Why Should you trade XAUUSD

Gold is traditionally considered a safe haven asset. During times of economic uncertainty or geopolitical instability, investors often turn to gold as a store of value. This can lead to increased volatility and trading opportunities in the XAU/USD pair.

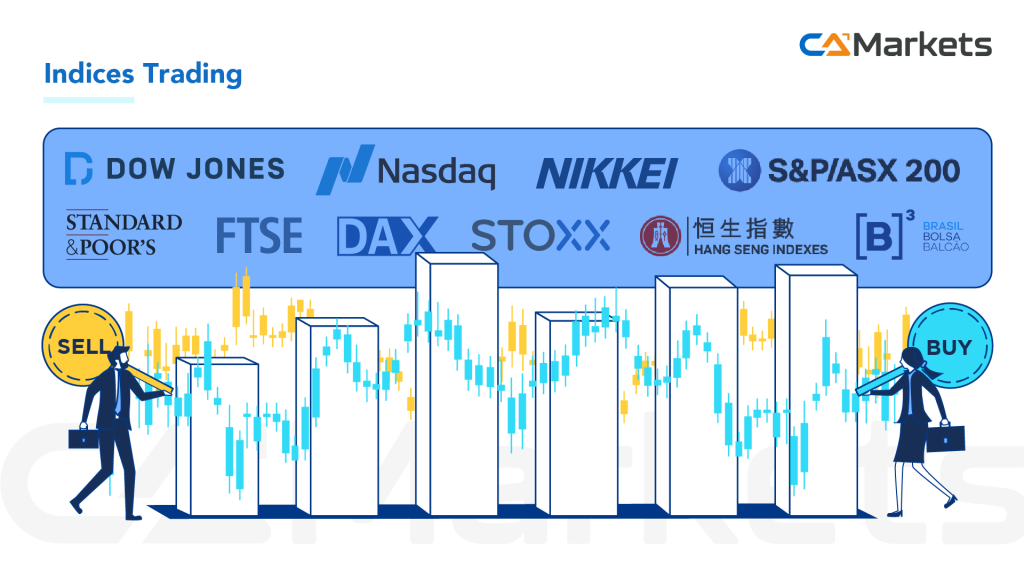

Understanding of Index Trading

Indices in finance are statistical measures representing the performance of a group of assets within a market. They act as benchmarks or indicators that reflect the overall health and direction of specific segments of the financial markets. These indices are constructed by aggregating the prices of selected stocks, bonds, commodities, or other assets that collectively represent a particular sector, region, or the market as a whole.

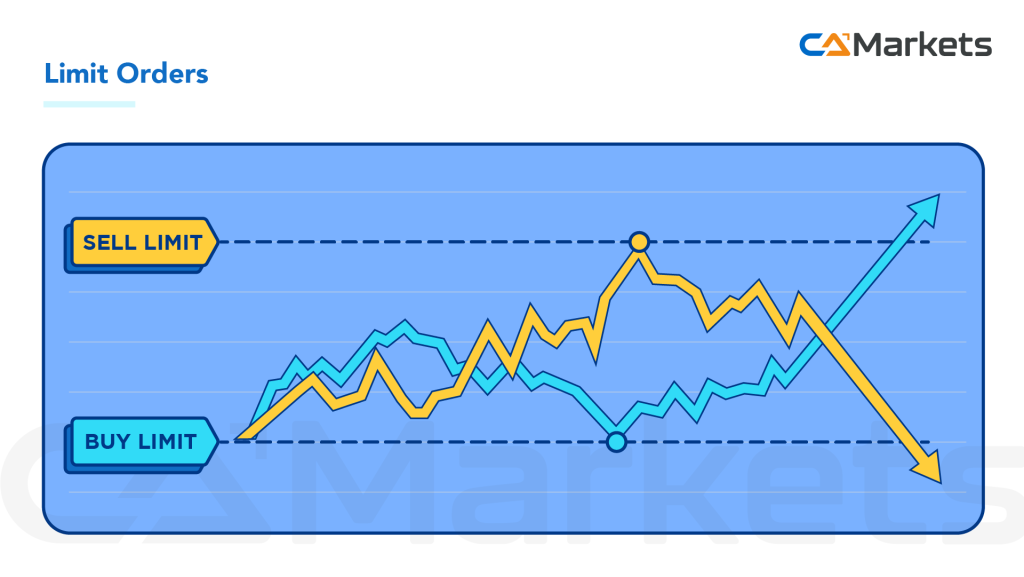

CFD Trading Order Types: Stop Loss & Limit Orders

In Forex CFD trading, a limit order is a directive given to a broker to execute a trade at a predetermined price or better. Rather than entering the market immediately at the current price, traders use limit orders to specify the exact price they wish to buy or sell a currency pair.