What is the FRA 40 index?

The CAC 40 index is a benchmark French stock market index that represents the 40 largest and most actively traded companies listed on the Euronext Paris exchange. Established in 1987, it serves as a key indicator of the performance of the French equity market and includes major firms across various sectors, such as finance, industry, and technology. The index is weighted by market capitalization, meaning companies with a larger market value have a greater impact on its movements. Investors and analysts use the CAC 40 to gauge the overall health and direction of the French economy and its stock market.

How is the FRA 40 index calculated?

The CAC 40 index is calculated using a market capitalization-weighted methodology. This means the index value is determined by summing the market capitalizations of the 40 constituent companies and then adjusting this sum to a base value. Each company’s market capitalization is calculated by multiplying its share price by the number of outstanding shares. The index is then adjusted for the free float, which reflects only the shares available for public trading, excluding those held by insiders or major stakeholders. Additionally, the CAC 40 is recalculated every 15 seconds during trading hours to reflect real-time price changes.

CAC40 Companies (FRA 40) – Sector Breakdown

The CAC 40 index encompasses a diverse array of sectors, reflecting the broad scope of the French economy. Key sectors include Financials, which dominate with major banks and insurance companies; Consumer Goods, featuring prominent firms in food, beverages, and luxury items; Healthcare, including pharmaceutical and biotechnology companies; Industrials, comprising manufacturing and engineering firms; Technology, which covers IT services, telecommunications, and electronics; Energy, representing oil, gas, and renewable energy sectors; and Utilities, providing essential services such as electricity and water. This sectoral distribution provides a comprehensive overview of France’s economic landscape and highlights the index’s role in tracking various aspects of the French market.

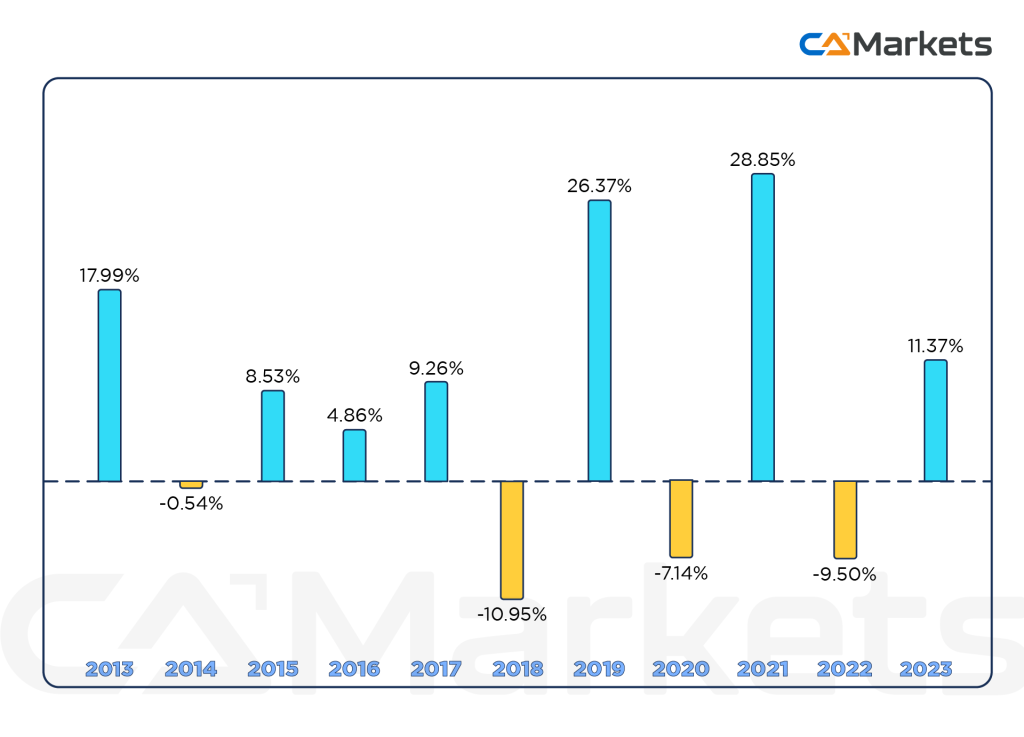

Historical trends of the FRA40 index

Over the past decade, the CAC 40 index has generally delivered a positive average return, reflecting a period of economic recovery and growth following the global financial crisis and subsequent market downturns. From around 2014 to 2024, the index has experienced annualized returns of approximately 6% to 8%, driven by economic improvements in France and broader European markets, corporate earnings growth, and increased investor confidence. However, returns have been marked by periods of volatility, influenced by global events such as the COVID-19 pandemic, geopolitical tensions, and economic policy shifts. Despite these fluctuations, the CAC 40 has shown resilience and an upward trend over the long term.

What affects the price of FRA40

The price of the FRA 40 index, which represents the 40 largest companies listed on the Euronext Paris exchange, is influenced by several factors:

1. Economic Data: Indicators such as GDP growth, unemployment rates, and inflation affect investor sentiment and can impact the index’s performance.

2. Corporate Earnings: The financial health and performance of the constituent companies, reflected in their earnings reports, directly influence the index.

3. Monetary Policy: Decisions by the European Central Bank (ECB) regarding interest rates and monetary policy can affect market liquidity and investment flows.

4. Geopolitical Events: Political stability, international trade agreements, and geopolitical tensions can create market volatility and impact the index.

5. Market Sentiment: Investor confidence and broader market trends, including global economic conditions and investor behaviour, play a significant role.

6. Exchange Rate Movements: Fluctuations in the euro’s value against other currencies can impact multinational companies and thus affect the index.

7. Sector Performance: As the FRA 40 includes companies from various sectors, changes in sector-specific conditions and trends can influence the index’s overall performance.ecosystem and external market factors, including technological advancements, regulatory news, market sentiment, and broader economic conditions.