What is the AEX index?

The AEX index, or Amsterdam Exchange Index, is the principal stock market index for the Netherlands. Also referred to as AEX25 or NETH25, it tracks the performance of the 25 largest and most actively traded companies listed on Euronext Amsterdam, the country’s main stock exchange. As a market capitalization-weighted index, the influence of each company on the AEX is proportional to its market value.

The AEX index serves as a benchmark for the Dutch stock market, offering investors and traders a broad view of market performance. It is reviewed quarterly, with companies being added or removed based on criteria such as market capitalization, liquidity, and sector representation. The index includes major firms from various sectors, including financial services, technology, consumer goods, healthcare, and energy. Notable constituents include ABN Amro, Heineken, ING Group, and Shell.

For traders and investors, the AEX index is a valuable tool for gauging investor sentiment and the overall economic health of the Netherlands.

How is the AEX25 index calculated?

The AEX25 index, also known as the Amsterdam Exchange Index, is calculated using a market capitalization-weighted methodology. This means that the index value is determined by summing the market capitalizations of the 25 largest and most actively traded companies listed on Euronext Amsterdam, then dividing this total by a divisor to maintain continuity and account for changes like stock splits or company additions/removals. The resulting index value reflects the performance of these top companies, with larger firms having a greater impact on the index due to their higher market capitalization.

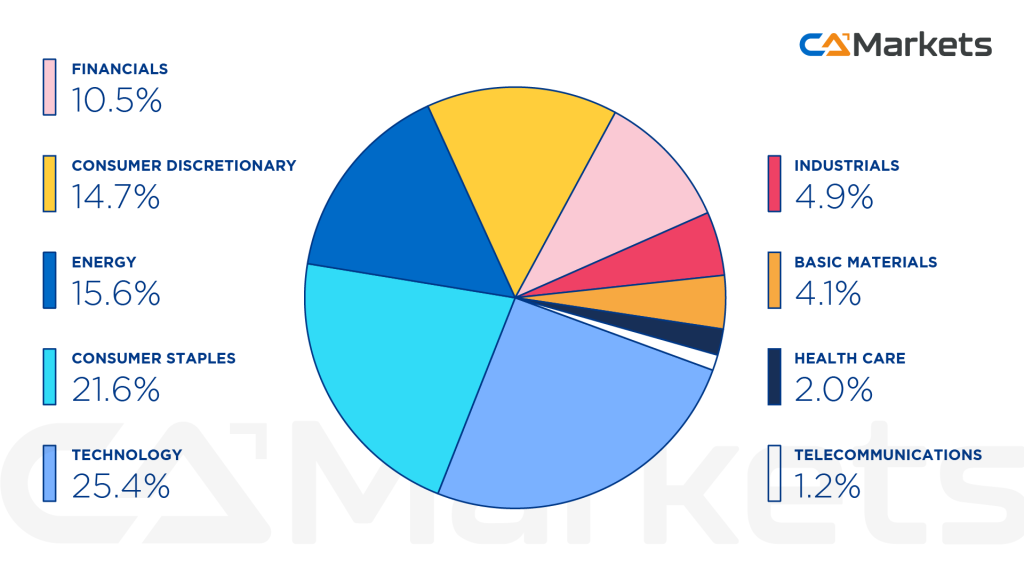

AEX 25 companies – Sector Breakdown

The Netherlands 25 Index, also known as the AEX25, features the 25 largest and most actively traded companies on Euronext Amsterdam, representing a broad spectrum of sectors within the Dutch economy. Key sectors include financial services, with major players like ING Group and ABN Amro; consumer goods, including firms like Heineken and Unilever; energy, represented by companies such as Shell; healthcare, with firms like Philips and Galapagos; technology, highlighted by ASML; industrial goods and services, including ArcelorMittal; utilities, such as Eneco; and telecommunications, represented by KPN. This diverse sector representation provides a comprehensive snapshot of the overall performance of the Dutch market.

Historical performance of the AEX index

The historical performance of the AEX index, or Amsterdam Exchange Index, showcases its evolution as a key indicator of the Dutch stock market.

- Early Years (1983-1990s): Launched in 1983, the AEX index initially saw modest fluctuations as it established itself. Throughout the late 1980s and early 1990s, it experienced steady growth, reflecting the expanding Dutch economy.

- Dot-com Bubble (1999-2001): During the late 1990s, the AEX index surged due to the global tech boom, reaching significant highs. However, the burst of the dot-com bubble in 2000 led to a sharp decline in the index.

- Financial Crisis (2007-2009): The global financial crisis severely impacted the AEX index, causing a dramatic drop from 2007 highs. The index fell significantly in 2008, mirroring the global economic downturn.

- Recovery and Growth (2009-2014): Following the financial crisis, the AEX index began a gradual recovery, reflecting improving economic conditions and market stabilization. This period saw moderate growth as the market adjusted to post-crisis realities.

- Recent Performance (2015-Present): The AEX index has generally experienced positive performance, driven by economic recovery, corporate earnings growth, and increased investor confidence. Key moments include the index reaching new highs during economic booms and experiencing fluctuations due to geopolitical and economic events. The index has shown resilience and adaptability, reflecting the broader economic trends in the Netherlands.

Overall, the AEX index’s historical performance highlights its role as a barometer for the Dutch stock market, with periods of growth, decline, and recovery influenced by global and local economic factors.

What affects the price of the AEX index?

The price of the AEX index, like other major stock indices, is influenced by a range of factors reflecting the overall health of the Dutch stock market and the broader economic environment. These factors interplay to influence the AEX index, making it a dynamic reflection of both domestic and international economic conditions.

1. Corporate Earnings: The financial performance of the companies listed in the AEX index directly affects its value. Strong earnings reports generally lead to a higher index value, while disappointing results can depress it.

2. Economic Indicators: Data such as GDP growth, unemployment rates, and consumer confidence can influence investor sentiment and market performance. Positive economic indicators tend to boost the index, while negative data can lead to declines.

3. Regulatory Changes: Updates in financial regulations from entities like the Netherlands Authority for the Financial Markets (AFM) and the Dutch National Bank can impact market activity and investor behavior, thereby affecting the index.

4. Monetary Policy: Decisions made by the European Central Bank (ECB), particularly regarding interest rates, affect borrowing costs and overall economic conditions, influencing the performance of the index.

5. Currency Fluctuations: The value of the euro against other major currencies (e.g., the USD) can impact Dutch companies’ competitiveness and profitability, influencing the index’s performance.

6. Global Economic Trends: International economic conditions, including global growth rates and trade dynamics, can affect Dutch exports and the performance of companies within the index.

7. Market Sentiment: Investor sentiment, driven by news, geopolitical events, and market speculation, can lead to price volatility in the index. Positive sentiment generally supports higher index levels, while negative sentiment can lead to declines.

8. Sector Performance: The AEX index’s composition means that sector-specific performance, such as in technology or energy, can significantly impact the overall index value, especially if major companies in those sectors perform well or poorly.

9. Unexpected Events: Unforeseen events such as natural disasters, geopolitical conflicts, or pandemics can create market uncertainty and affect the index’s value by influencing investor confidence and economic stability.

10. Trading Activity: Market liquidity and trading volumes can also influence index movements. High trading volumes often reflect strong investor interest and can lead to more significant price movements.