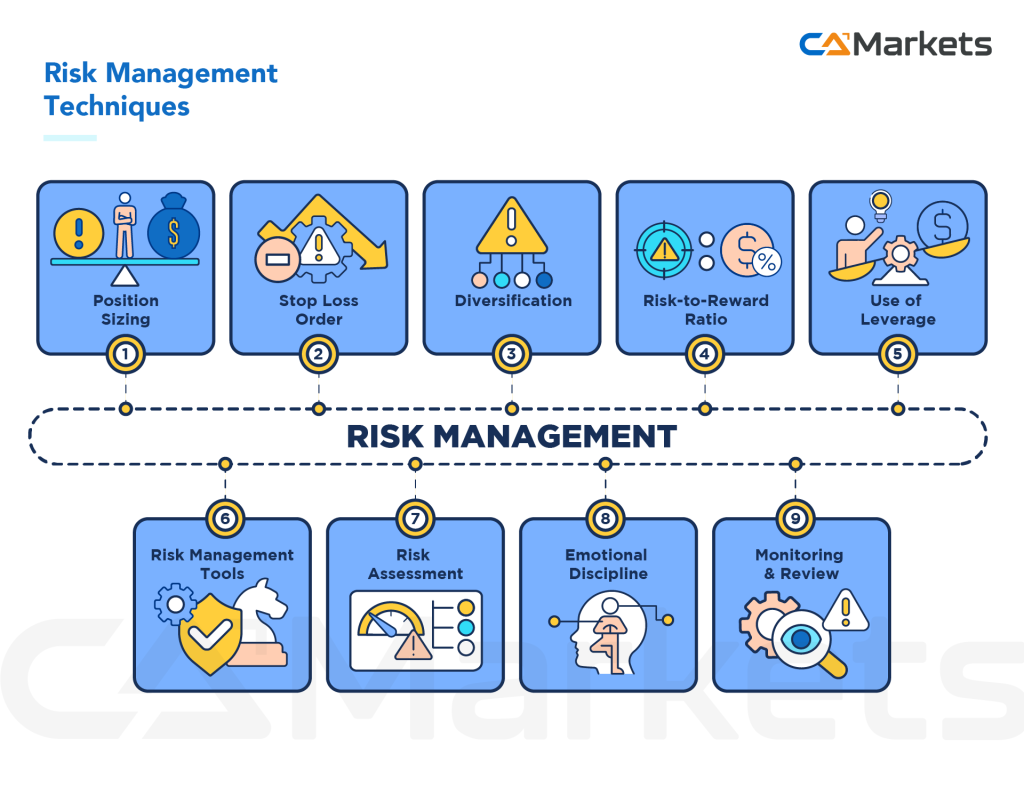

In trading, the cornerstone of effective risk management involves three crucial steps aimed at sustaining profitability and mitigating potential setbacks. Initially, traders must adeptly identify the diverse risks inherent in the market, encompassing factors such as volatility, credit exposure, liquidity constraints, operational risks, and geopolitical influences. Subsequently, a thorough analysis of these identified risks is undertaken, combining quantitative methodologies with qualitative assessments to gauge their potential impact and likelihood of occurrence. Armed with this understanding, traders proceed to implement targeted risk mitigation strategies.

These include judiciously determining position sizes, employing stop-loss orders to cap potential losses, diversifying portfolios to spread risk, utilizing hedging techniques, and leveraging risk management tools such as trailing stops and options. By diligently executing these fundamental practices, traders can fortify their positions against uncertainties, preserve capital, and enhance their ability to navigate the complexities of financial markets effectively.

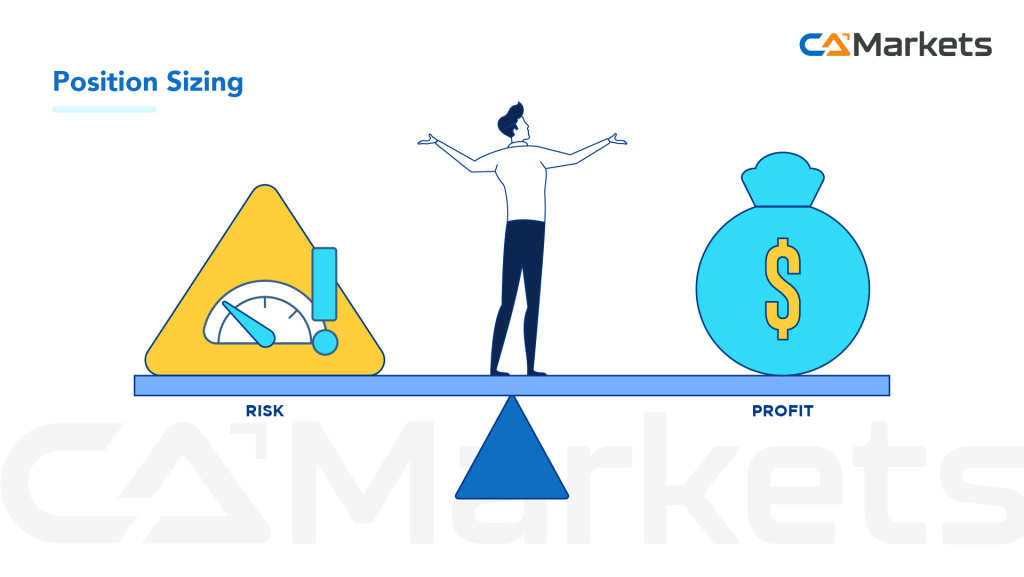

Position Sizing

Position sizing in forex trading is pivotal for effective risk management, focusing on determining the appropriate allocation of capital to each trade. This practice is fundamental as it directly impacts potential gains and losses. The process begins with evaluating individual risk tolerance and the size of the trading account, typically recommending a conservative approach of risking between 1% to 3% of total capital per trade. Key to this strategy is the placement of stop-loss orders, which define the maximum loss per trade based on the distance between entry and stop levels.

Calculating the exact position size involves using a formula that considers these factors, ensuring that risk is controlled and aligned with the trader’s overall risk management strategy. Regular assessment and adjustment of position sizing are essential to adapt to market conditions and maintain consistent risk management practices over time, safeguarding capital and optimizing trading outcomes in the dynamic forex market.

Stop-Loss Orders

Stop-loss orders play a crucial role in risk management within the realm of forex trading. These orders are predefined price levels set by traders to automatically execute a trade exit if the market moves against their position, thereby limiting potential losses. The primary objective of stop-loss orders is to protect trading capital by mitigating the impact of adverse price movements. By strategically placing stop-loss orders, traders can control risk exposure and ensure that losses remain within predetermined thresholds. This practice not only safeguards capital but also allows traders to maintain emotional discipline and avoid making impulsive decisions during market volatility. Implementing stop-loss orders effectively involves considering market conditions, volatility levels, and the specific trading strategy employed, ensuring a balanced approach between risk management and profit potential in forex trading.

Diversification

Diversification in forex trading risk management involves spreading investments across different currency pairs or strategies to reduce overall risk exposure. This strategy aims to mitigate potential losses from adverse movements in any single pair or market condition by balancing the portfolio. Traders achieve diversification by allocating funds across multiple currency pairs with varying market reactions, employing different trading strategies and timeframes, and considering geographical factors. While diversification does not eliminate risk entirely, it is a crucial approach in forex trading to enhance stability and optimize long-term profitability by spreading risk across different instruments and market scenarios.

Risk-to-Reward Ratio

The risk-to-reward ratio is a critical aspect of forex trading risk management, assessing the potential profit against the potential loss for each trade. Typically expressed as a ratio like 1:2 or 1:3, it indicates the expected return relative to the amount at risk. For instance, a 1:2 ratio means aiming for twice the potential profit compared to the potential loss. Traders use this ratio to evaluate whether a trade offers a favorable balance between risk and reward. A higher ratio suggests a more attractive trade where potential rewards outweigh the risks involved. By consistently applying a balanced risk-to-reward ratio in their trading strategies, traders aim to enhance profitability while effectively managing risks in the volatile forex market.

Use of Leverage

Leverage in forex trading enables traders to control larger positions with a smaller amount of capital, potentially amplifying profits but also increasing the risk of substantial losses if trades move unfavorably. Effective risk management involves carefully managing leverage ratios, typically ranging from 10:1 to 200:1 or higher, depending on broker policies. Traders should assess their risk tolerance and trading strategy to determine appropriate leverage levels. Strategies include setting strict stop-loss orders and limiting leverage per trade to mitigate potential losses. By balancing the benefits of amplified returns with the risks associated with leverage, traders can prudently manage their exposure and navigate the volatile forex market more effectively.

Risk Management Tools

Risk management tools in forex trading are crucial for minimizing potential losses and maximizing trading efficiency. These tools include stop-loss orders, which automatically close trades at predetermined levels to limit losses, and take-profit orders, which secure profits by closing trades at specified target levels. Trailing stops adjust automatically as trades move in favor, helping to protect gains while allowing for potential further profit. Guaranteed stop-loss orders ensure execution at specified prices, shielding traders from slippage during volatile market conditions. Position size calculators assist in determining appropriate trade sizes based on risk tolerance and account size, while risk/reward ratio calculators evaluate potential trade setups before execution. Correlation tools help manage exposure to related currency pairs or assets, while volatility indicators aid in adjusting strategies based on market conditions. Together, these tools empower traders to execute disciplined, well-informed trades, safeguarding capital and aiming for consistent profitability in forex trading.

Risk Assessment

Risk assessment in forex trading involves evaluating potential risks associated with market volatility, economic events, and trading decisions to make informed trading choices. Traders assess both quantitative factors, such as historical data and technical analysis, and qualitative factors, such as market sentiment and geopolitical events, to gauge potential risks. Key aspects of risk assessment include identifying the probability of adverse market movements, analyzing the potential impact on trades and portfolios, and implementing strategies to mitigate identified risks. This process helps traders anticipate and manage risks effectively, enhancing their ability to navigate the dynamic forex market with greater confidence and resilience.

Emotional Discipline

Emotional discipline is a vital aspect of risk management in forex trading, focusing on controlling and managing emotions to make rational trading decisions. It involves maintaining a balanced mindset and adhering strictly to trading plans and risk management strategies despite fluctuations in the market or emotional impulses. Traders with emotional discipline avoid making impulsive trades based on fear, greed, or overconfidence, which can lead to irrational decisions and potential losses. Instead, they maintain a consistent approach to risk assessment, position sizing, and the use of stop-loss orders to protect capital. By cultivating emotional discipline, traders can mitigate emotional biases and maintain a disciplined trading mindset essential for long-term success in forex trading.

Monitoring and review are integral aspects of risk management in forex trading, essential for maintaining effective control over trading outcomes. Traders consistently monitor their positions, market conditions, and economic events to swiftly identify any deviations from their trading plan or unexpected market shifts. This proactive approach allows for timely adjustments in strategy to mitigate risks and capitalize on opportunities. Reviewing involves analyzing past trades and overall performance to assess the efficacy of risk management tactics such as stop-loss orders and position sizing. By learning from past experiences and identifying areas for improvement, traders can enhance their ability to manage risks prudently and optimize their trading decisions in the dynamic forex market.