What is silver?

In financial trading circles, silver is highly valued for its distinctive properties, inherent worth as a precious metal, and its conductivity. With a rich historical lineage spanning centuries, silver has found extensive use across diverse sectors like electronics, photography, and solar energy.

In contemporary markets, silver plays a crucial role as a modern financial instrument and a reliable hedge against inflation and economic instability. Renowned for its affordability and wide-ranging applications, silver stands out as a favored commodity for trading. It can be traded in various forms, ranging from physical bullion like bars and coins to financial derivatives such as contracts for difference (CFDs).

How does silver trading work?

Silver trading revolves around the buying and selling of silver contracts or physical bullion, aimed at capitalizing on price movements. It’s a dynamic financial endeavour characterized by several key elements:

Market Participants: Participants in silver trading encompass a wide spectrum, ranging from individual retail traders to large institutional investors and speculators. Each brings their own strategies and objectives to the market.

Trading Strategies: Silver traders employ various strategies tailored to their goals and market conditions. These strategies include day trading for short-term gains, swing trading to capture medium-term price swings, and long-term investing for those seeking to profit from broader market trends.

Risk Management: Effective risk management is essential in silver trading to mitigate potential losses and safeguard capital. Traders commonly utilize risk management tools such as stop-loss orders, which automatically trigger a sale if the price reaches a predetermined level, thus limiting downside risk.

Regulations: The silver trading market operates under regulatory oversight to ensure fairness, transparency, and investor protection. Traders need to be aware of and comply with relevant regulations governing trading practices and market conduct.

Overall, silver trading combines the complexities of financial analysis, market dynamics, and risk management to navigate price volatility and achieve profitable outcomes. Understanding these elements is crucial for participants aiming to succeed in this dynamic sector of the financial markets.

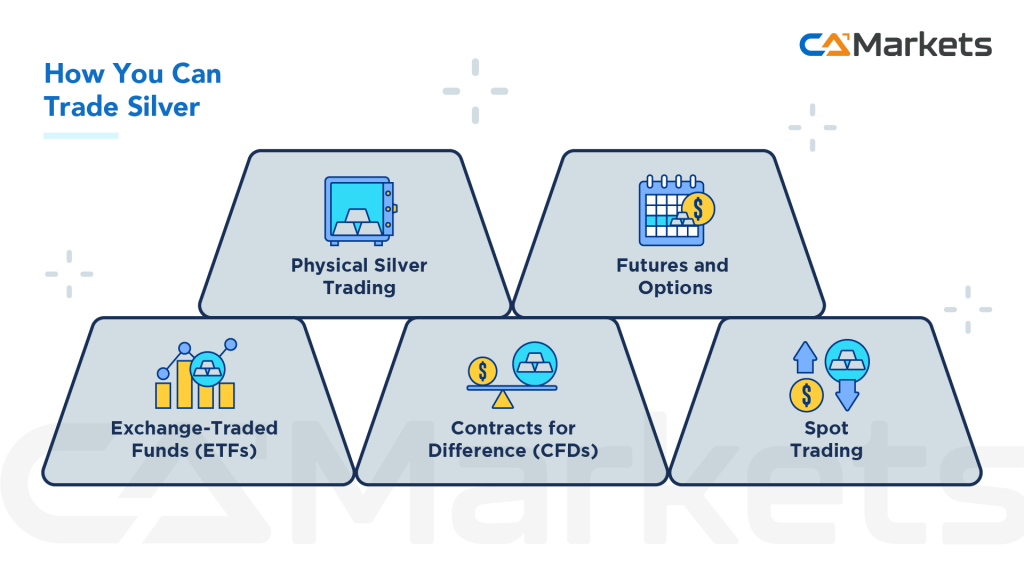

How can you trade silver?

Silver trading operates through various avenues, each catering to different investor preferences and objectives.

Physical Silver Trading:

- Bullion: Investors can purchase physical silver in the form of bars or coins from dealers or mints. The price typically reflects the current spot price of silver plus a premium.

- Storage: Investors may choose to store physical silver themselves or use specialized storage facilities like vaults provided by banks or storage companies.

Futures and Options:

- Futures Contracts: These are standardized contracts traded on commodities exchanges (e.g., COMEX in the U.S.). Futures contracts specify the quantity and quality of silver to be delivered at a future date at a price agreed upon today.

- Options Contracts: Options give the buyer the right, but not the obligation, to buy (call option) or sell (put option) silver at a specified price within a set timeframe.

Exchange-Traded Funds (ETFs):

- Silver ETFs: These funds hold physical silver bullion and trade on stock exchanges like stocks. They allow investors to gain exposure to silver prices without holding physical metal.

Contracts for Difference (CFDs):

- CFD Trading: This involves trading contracts based on the price movements of silver without owning the physical metal. CFDs allow for leveraged trading, where investors can take positions with only a fraction of the total contract value as margin.

Spot Trading:

- Spot Market: Involves buying or selling silver for immediate delivery (within a few days) at the current market price (spot price). Transactions in the spot market can be executed directly between buyers and sellers or through brokers.

Overall, silver trading offers investors flexibility through different instruments and strategies to capitalize on price movements and manage risks associated with market fluctuations and economic uncertainties.

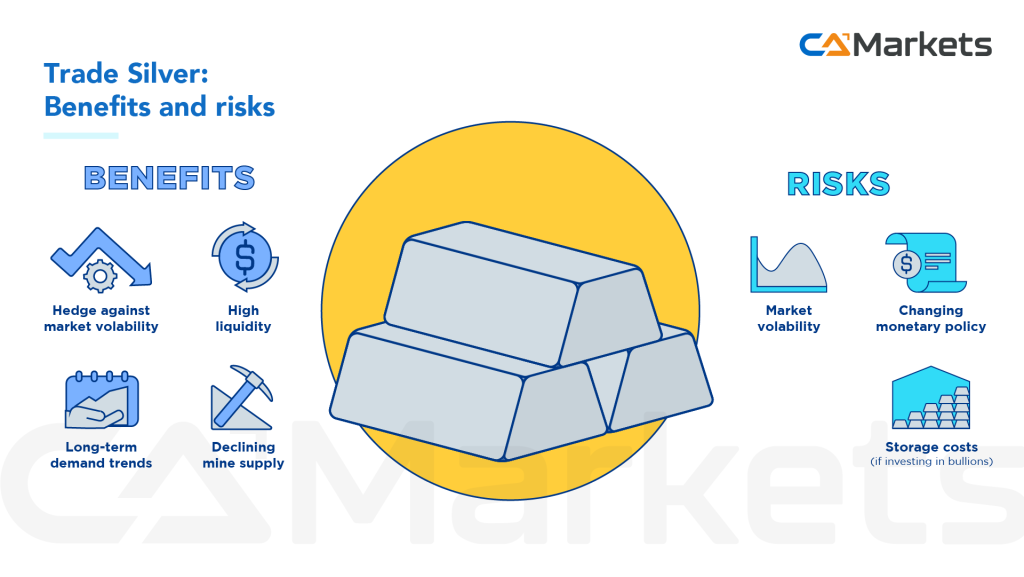

Why Trade or Invest in Silver?

Investing in silver offers numerous advantages that appeal to both experienced investors and newcomers to trading. Here’s an exploration of the potential benefits:

- Intrinsic Value: Silver possesses inherent value derived from its widespread industrial applications. This practical use in sectors such as electronics and renewable energy ensures ongoing demand, contributing to its stability as a tangible asset.

- Safe-Haven Asset: Historically, silver has served as a safe haven asset, meaning it tends to retain or increase its value during times of economic uncertainty or inflation. This characteristic makes it an attractive choice for investors seeking to safeguard their wealth.

- Portfolio Diversification: Including silver in an investment portfolio can effectively diversify risk. Silver’s performance often behaves differently than stocks and bonds, thus reducing overall portfolio volatility and potentially enhancing returns.

- Liquidity: The silver market is highly liquid, meaning it allows for efficient buying and selling transactions. This liquidity ensures that investors can enter and exit positions with relative ease, enhancing flexibility and responsiveness to market conditions.

- Industrial Demand: Silver’s extensive use in various industries, especially electronics and renewable energy technologies like solar panels, provides a strong underlying demand. Increases in industrial applications can stimulate demand for silver and contribute to price appreciation.

- Historical Performance: Over time, silver has demonstrated the potential for significant price appreciation. Historical data shows periods where silver prices have risen substantially, attracting investors seeking capital growth opportunities.

In summary, investing in silver offers a blend of tangible value, diversification benefits, and potential for capital appreciation, making it a compelling asset class within the broader spectrum of investment options. Understanding these advantages can help investors make informed decisions to align their investment strategies with their financial goals and risk tolerance levels.

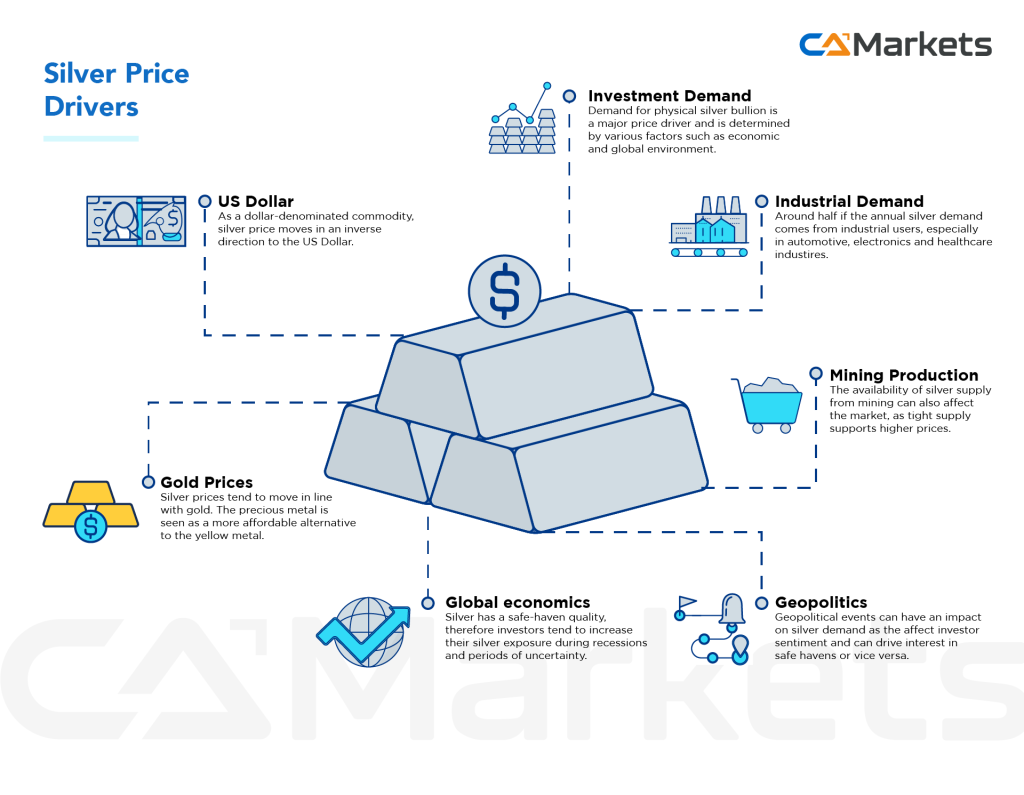

What affects the price of silver?

Trading silver, like any precious metal, requires careful consideration of various factors that can influence its price dynamics. Here’s a detailed look at these key factors:

1. Supply and Demand Dynamics

- Mining Production: Changes in silver mining output can directly impact supply levels in the market. Higher production tends to increase supply, potentially putting downward pressure on prices.

- Industrial Use: Silver’s industrial applications, including electronics, solar panels, and medical devices, drive significant demand. Fluctuations in industrial production and technological advancements can affect demand levels.

- Investment Demand: Investor interest in silver as a store of value or hedge against economic uncertainty can lead to fluctuations in demand. This includes demand for physical bullion, ETFs, and other silver-related investment products.

2. Market Sentiment

- Economic Indicators: Data such as GDP growth, employment figures, and inflation rates can influence investor sentiment and perceptions of silver as a safe haven asset.

- Geopolitical Events: Political instability, trade tensions, and geopolitical conflicts can create uncertainty in financial markets, prompting investors to seek safe haven assets like silver.

- Speculative Trading: Short-term price movements in silver can be driven by speculative trading activities, where traders buy or sell based on anticipated price movements rather than underlying fundamentals.

3. Currency Movements

- Silver is traded globally, often quoted in US dollars. Changes in exchange rates, especially the strength or weakness of the US dollar, can impact the price of silver. A stronger dollar typically makes silver more expensive for holders of other currencies, potentially reducing demand.

4. Industrial Demand:

- Silver’s use in industrial applications is crucial. For instance, demand for silver in electronics for conductive pastes or in solar panels for photovoltaic cells can fluctuate with technological advancements and economic conditions.

When trading silver, it’s essential to consider these factors and how they interplay to determine price movements. Traders should develop a clear strategy that accounts for potential advantages and risks, select appropriate trading instruments (like physical silver, futures, or ETFs), and stay informed about market developments and economic indicators that could impact silver prices. Diligence in understanding these dynamics can help traders navigate the complexities of the precious metals market effectively.