What is the S&P/ASX 200 index?

The S&P/ASX 200 index is a key benchmark for the Australian stock market, representing the 200 largest companies listed on the Australian Securities Exchange (ASX) based on market capitalization. Launched in 2000, it is designed to reflect the performance of the broad Australian equity market, including a diverse range of sectors such as finance, materials, and healthcare. The index is market-capitalization-weighted, meaning that companies with larger market values have a greater impact on its movements. It serves as a vital tool for investors to gauge the overall health and direction of the Australian economy and provides a basis for various investment products and financial analysis.

How is the S&P/ASX 200 index calculated

The S&P/ASX 200 index is calculated using a market capitalization-weighted methodology. This methodology ensures that the index accurately represents the performance of the largest and most liquid companies in the Australian market.

1. Market Capitalization: Each company in the index is weighted according to its market capitalization, which is calculated by multiplying the company’s share price by the number of outstanding shares.

2. Free Float Adjustment: The index uses a free-float adjustment, which considers only the shares available for public trading, excluding shares held by insiders and large stakeholders. This adjustment ensures that the index reflects the market impact of shares that are actively traded.

3. Index Calculation: The index value is determined by summing the market capitalizations of all the constituent companies and then dividing by a divisor. The divisor is a figure used to normalize the index value and adjust for corporate actions such as stock splits and changes in the index composition.

4. Real-Time Updates: The S&P/ASX 200 is recalculated continuously throughout the trading day to reflect real-time changes in the share prices of its constituent companies.

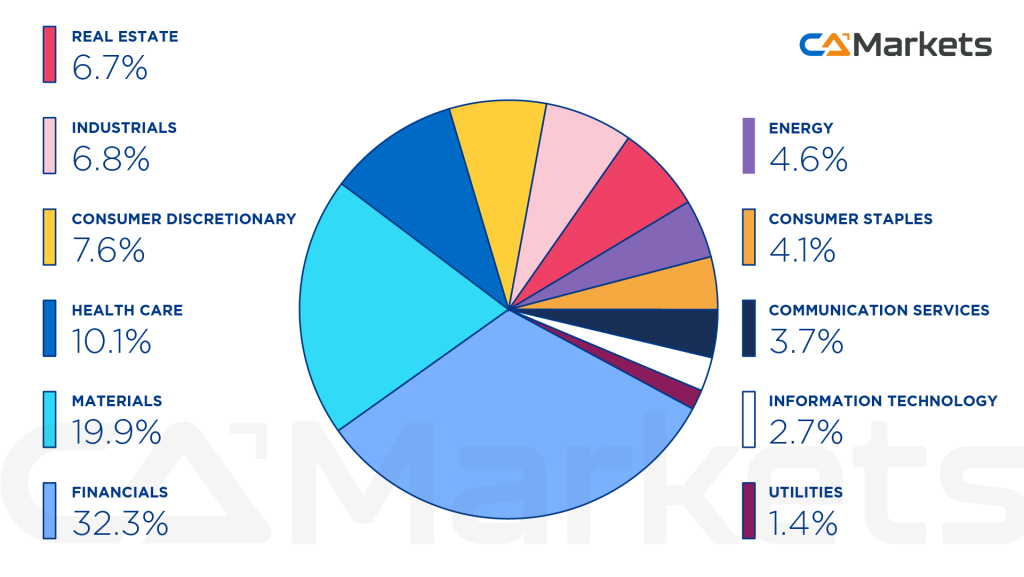

ASX 200 Companies – Sector Breakdown

The S&P/ASX 200 index features a diverse range of sectors, reflecting the broad scope of the Australian economy. The largest sector is Financials, including major banks and insurance companies, which make up a significant portion of the index. Materials follow, encompassing companies involved in mining, metals, and resources, which are crucial due to Australia’s rich natural resources. Healthcare is another key sector, representing pharmaceutical and biotechnology firms. Consumer Discretionary and Consumer Staples sectors include retail and essential goods companies, respectively. Industrials cover manufacturing and infrastructure firms, while Energy focuses on oil, gas, and renewable energy companies. Utilities provide essential services such as electricity and water. Technology and Telecommunications sectors include IT and communication service providers. This sectoral distribution provides a comprehensive snapshot of the Australian market’s economic landscape.

The average annual return of the ASX 200

The average annual return of the S&P/ASX 200 index over recent years has generally been in the range of 7% to 10%. This figure reflects the index’s performance across various market cycles, incorporating periods of economic growth and downturns. The return includes both capital gains and dividends, which are reinvested. The index’s performance is influenced by factors such as economic conditions in Australia, global market trends, commodity prices, and sector-specific dynamics. While the ASX 200 has shown resilience and long-term growth, returns can vary annually based on these influencing factors and market volatility.

How to trade ASX 200

Contract for Difference (CFD) trading provides a cost-effective and efficient way for traders to engage with the ASX 200 index. Brokers typically offer CFDs based on the Cash Index (AUS 200) and the underlying Futures contract (SPI 200). CFDs allow traders to speculate on the price movements of the ASX 200 without needing to own the actual index or its constituent stocks. Utilizing leverage, traders can amplify their exposure to price changes and can take both long and short positions. This flexibility is particularly advantageous during market downturns, as traders can speculate on falling prices without having to sell off a significant portion of their portfolio, thereby avoiding high transaction costs and the challenges of market timing.