What are indices?

Indices in finance are statistical measures representing the performance of a group of assets within a market. They act as benchmarks or indicators that reflect the overall health and direction of specific segments of the financial markets. These indices are constructed by aggregating the prices of selected stocks, bonds, commodities, or other assets that collectively represent a particular sector, region, or the market as a whole.

Indices are characterized by their composition, which includes a predefined set of assets chosen based on criteria like market capitalization or sector classification. They vary in terms of weighting methodologies, with some giving more importance to larger companies (market-cap weighted) or equally weighting all components. Investors and analysts use indices to gauge market trends, investor sentiment, and economic conditions, as well as to benchmark the performance of investments or portfolios. Popular examples include the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite, each representing different segments of the US stock market.

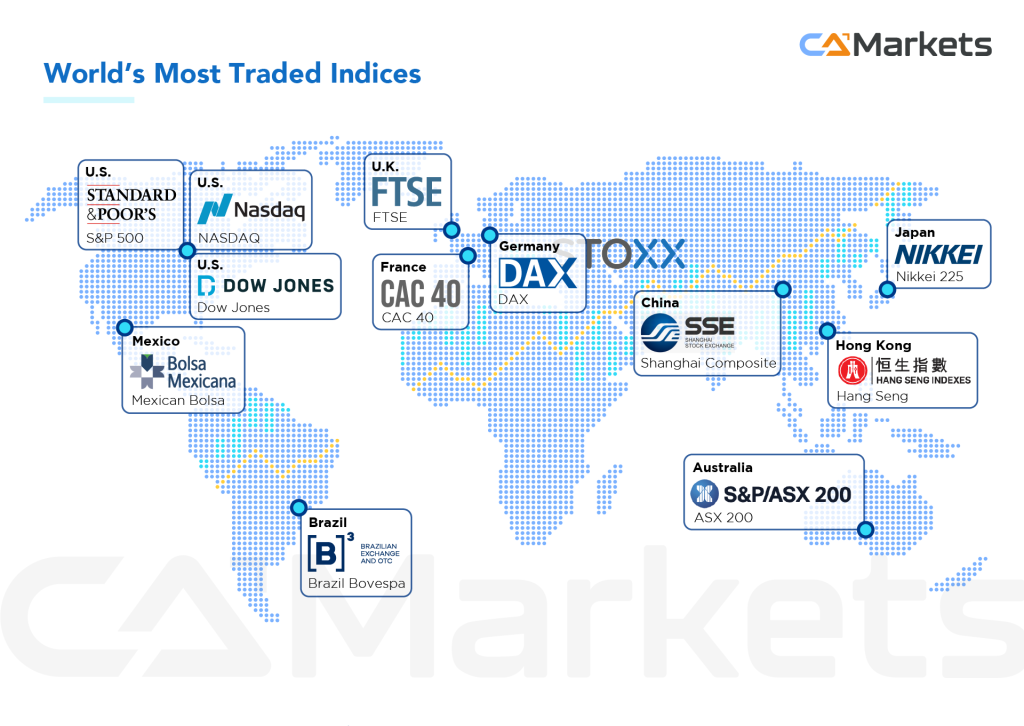

Some of the world’s most actively traded indices include widely recognized benchmarks like the S&P 500, which encompasses 500 large-cap US companies spanning various sectors and is a prominent gauge of the US stock market. Another notable index is the Dow Jones Industrial Average (DJIA), composed of 30 significant US companies known as blue-chip stocks, offering insights into the performance of key industries. The NASDAQ Composite tracks over 3,000 stocks listed on the NASDAQ exchange, focusing on technology, biotech, and growth sectors. Internationally, the FTSE 100 reflects the market performance of the largest 100 companies listed on the London Stock Exchange, while Germany’s DAX index monitors the top 30 companies traded on the Frankfurt Stock Exchange. Additionally, Japan’s Nikkei 225 showcases the performance of 225 major companies listed on the Tokyo Stock Exchange, and Hong Kong’s Hang Seng Index tracks the top 50 companies listed on the Hong Kong Stock Exchange. These indices play crucial roles in providing insights into regional and global market trends, economic conditions, and investor sentiment across various sectors and geographic regions.

Why should you trade indices?

Trading indices offers compelling advantages for investors and traders alike. They provide diversified exposure to a wide range of stocks or assets within specific markets or sectors, reducing the risks associated with individual stock investments. Serving as benchmarks, indices offer insights into overall market performance, economic conditions, and investor sentiment. Their high liquidity ensures efficient trading with narrow bid-ask spreads and ample trading volumes. Accessible through various financial instruments such as index futures, options, and ETFs, indices enable flexible trading strategies and effective risk management through tools like stop-loss orders. By offering cost-effective portfolio diversification and valuable market insights, trading indices remains a preferred method for capturing broad market trends and potential investment opportunities in global financial markets.

How to trade indices?

Trading indices involves a systematic approach to capitalize on market movements while managing risk effectively. Begin by selecting a suitable index aligned with your trading strategy, considering factors like volatility and sector exposure. Choose from various trading instruments such as index futures, options, or ETFs, each offering distinct advantages in terms of leverage, liquidity, and expiration dates. Conduct thorough market analysis using both technical indicators and fundamental factors to assess current market conditions and anticipate trends. Develop a comprehensive trading plan that includes precise entry and exit points, along with risk management strategies like setting stop-loss orders and determining position sizes based on your risk tolerance. Execute trades through a reliable brokerage platform, monitoring market movements closely to execute your plan effectively. Continuously monitor and adjust your trading strategy in response to evolving market dynamics and stay informed about economic data releases and geopolitical events that may impact the index’s performance. By adhering to these steps and maintaining discipline, traders can enhance their chances of trading indices successfully and navigating the complexities of global financial markets.

Stock Trading VS Indices Trading

Scope and Composition

Stock trading involves buying and selling shares of individual companies listed on stock exchanges. Each stock represents ownership in a specific company, and traders focus on analyzing company fundamentals, earnings reports, and industry trends to make informed trading decisions. In contrast, indices trading involves trading a basket of stocks that represent a particular market segment or sector. Indices reflect the collective performance of these stocks and serve as benchmarks for market movements and economic conditions.

Risk and Diversification

Stock trading carries specific company-related risks, such as earnings disappointments, management changes, or industry-specific challenges. Indices trading offers diversification benefits as it spreads risk across multiple stocks within a market segment or sector. By trading indices, investors can reduce the impact of individual stock volatility on their portfolio.

Market Trends and Volatility

Stock prices can be highly volatile, influenced by company-specific news, market sentiment, and broader economic factors. Indices tend to exhibit less volatility compared to individual stocks due to diversification across multiple companies. Indices trading allows traders to capitalize on broader market trends rather than focusing on the performance of a single company.

Investment Strategies

Stock trading often involves strategies such as value investing, growth investing, or trading based on technical analysis of price charts. Indices trading strategies include trend following, market timing, or sector rotation, focusing on the performance of a group of stocks rather than individual companies.

Access and Liquidity

Stocks and indices both offer liquidity, but indices trading often involves highly liquid instruments such as index futures, options, or ETFs, providing efficient execution and price discovery. This liquidity facilitates trading large positions or adjusting exposure quickly compared to individual stocks.

Overall, while stock trading offers potential rewards from individual company performance, indices trading provides diversification benefits, reduced risk exposure, and opportunities to capitalize on broader market trends and economic indicators. Traders and investors often choose between these approaches based on their risk tolerance, investment objectives, and market outlook.