The DJIA, also known as the Dow, US30 or DJ30, holds significant stature as a market index tracking the top 30 publicly traded blue-chip companies in the United States. Created by Charles Dow and Edward Jones, it stands as the second-oldest US market index, following the Dow Jones Transportation Average.

The Dow gained prominence in the 20th century as it became evident that the performance of industrial companies closely mirrored the economic growth rate of the US. This solidified the DJIA as a crucial gauge of the American economy, a role it continues to fulfill today.

Despite tracking a relatively small number of companies compared to broader indices like the S&P 500, the Dow’s effectiveness as a market benchmark lies in the distinguished pedigree of its constituent list. These 30 companies span diverse sectors but share a common trait: each is a top-tier entity with a history of delivering stable earnings consistently over time. This selection criterion ensures that the Dow captures a snapshot of corporate America’s health and resilience, making it a trusted indicator for investors and economists alike.

How is the Dow Jones 30 calculated?

The Dow Jones Industrial Average (DJIA), commonly known as the Dow, is calculated using a straightforward price-weighted method. The DJIA’s price-weighted method gives equal importance to each stock’s price, making it unique compared to other major indices. It remains one of the most widely followed and recognized benchmarks for the U.S. stock market.

- Selection of Stocks: The Dow consists of 30 large, publicly traded companies selected by the editors of The Wall Street Journal, which is owned by Dow Jones & Company. These companies are considered leaders in their respective industries and are intended to represent a cross-section of the U.S. economy.

- Stock Prices: For each of the 30 component stocks, the current trading price (or closing price from the previous trading session) is used. This is typically the last traded price of the stock on the New York Stock Exchange (NYSE) or NASDAQ.

- Calculation: The DJIA is calculated by summing up the stock prices of all 30 component companies. The sum of these prices is then divided by a divisor, which is adjusted periodically to account for corporate actions such as stock splits, mergers, or other structural changes in the component companies. This divisor ensures continuity and consistency in the index’s calculation over time.

- Weighting: Unlike other indices such as the S&P 500, where companies are weighted based on their market capitalization (total market value of a company’s outstanding shares), the Dow is price weighted. This means that stocks with higher prices have a greater impact on the index’s movements, regardless of their market capitalization.

- Index Level: The resulting number from the calculation represents the level of the Dow Jones Industrial Average. Movements in the index reflect changes in the stock prices of its 30 component companies, providing a snapshot of overall market sentiment and economic health.

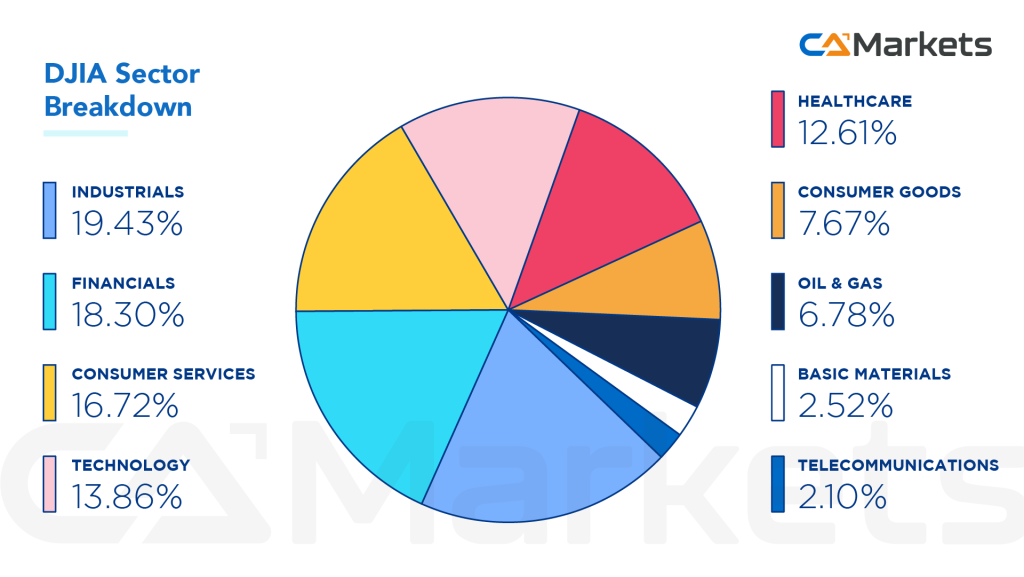

Dow Jones 30 Companies – Sector Breakdown

The Dow Jones Industrial Average (DJIA), known colloquially as the Dow 30, comprises 30 major publicly traded companies recognized as industry leaders. The sector classification of these companies can fluctuate over time due to factors such as mergers, acquisitions, and strategic shifts in business focus among the index’s constituents.

Periodic reviews ensure the index reflects current economic conditions and market trends accurately. These adjustments are crucial for maintaining the Dow’s role as a barometer of the overall U.S. stock market, providing insights into the performance and direction of key sectors within the economy.

How to trade Dow Jones 30

Trading the Dow Jones 30 via CFDs offers several advantages over traditional methods. CFDs allow you to speculate on the index’s price movements using leverage, which means you can open larger positions with a smaller initial deposit, known as margin. This enables potential for amplified profits, but also magnifies potential losses, as gains or losses are calculated based on the full position size rather than just your initial deposit.

With CFDs, you can take advantage of both rising and falling markets by going long (buying) or short (selling) without owning the actual shares. The market for CFDs on indices like the Dow Jones 30 is highly liquid, offering flexibility to trade 24/5 across different time zones, providing opportunities to react to market developments even outside regular trading hours.

Unlike traditional stock trading, CFD trading on the Dow Jones 30 is typically commission-free, with costs included in the spread, and may also incur overnight funding fees for holding positions overnight.

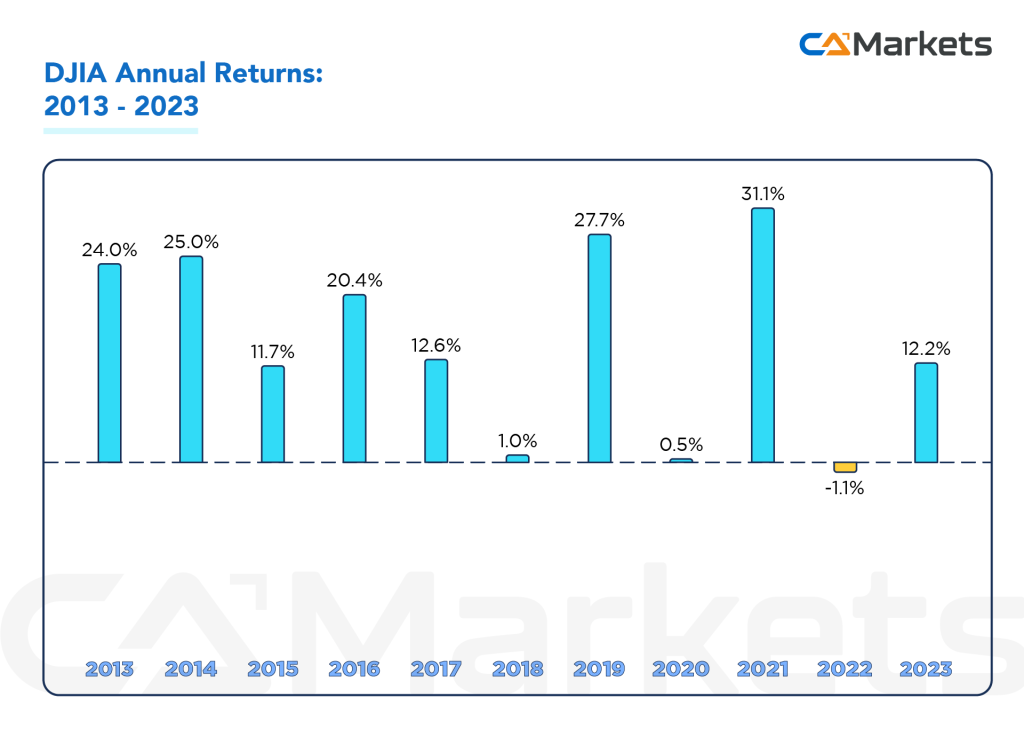

The average return on the Dow jones 30

The average return on the Dow Jones Industrial Average (DJIA), often referred to as the Dow 30, varies over different time periods and is influenced by market conditions, economic factors, and other variables. Historically, the average annual return of the Dow Jones 30 has been around 7% to 10% over long-term periods. This average includes both capital gains (increases in the index’s value) and dividends paid by component companies.

It’s important to note that annual returns can vary significantly from year to year, influenced by factors such as economic growth, corporate earnings, interest rates, geopolitical events, and investor sentiment. Investors often consider the Dow Jones 30 as a benchmark for the broader U.S. stock market’s performance and economic health.

For the most current and specific data on average returns, consulting financial news sources or market analysis tools would provide the latest insights.