In the Forex (foreign exchange) market, currencies are traded, the simple saying is ‘MONEY’. More specifically, traders exchange one currency for another with the aim of making a profit based on fluctuations in exchange rates.

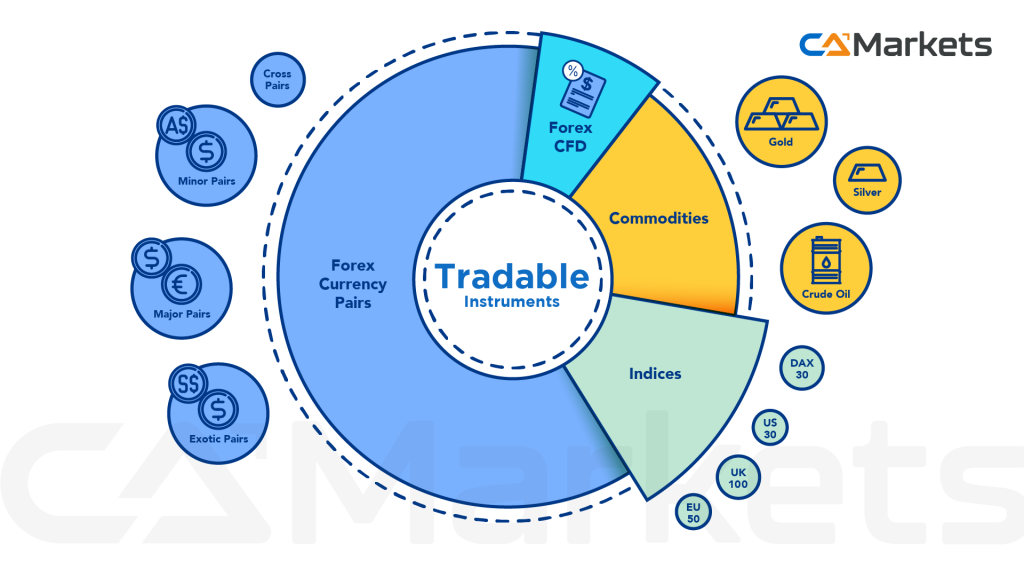

Currency Pairs

Currencies are traded in pairs, where one currency is exchanged for another. Each currency pair consists of a base currency and a quote currency. For example, in the EUR/USD currency pair, the Euro is the base currency and the US Dollar is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

Major Currency Pairs

These are the most frequently traded currency pairs in the Forex market. They include pairs like EUR/USD, USD/JPY, GBP/USD, USD/CAD , AUD/USD and USD/CHF. Major currency pairs typically involve currencies of major economies and enjoy high liquidity and trading volume.

Minor and Exotic Currency Pairs

Minor currency pairs (also known as cross currency pairs) do not include the US Dollar but involve other major currencies, such as EUR/GBP or AUD/JPY. Exotic currency pairs involve currencies from smaller or emerging market economies, such as USD/TRY (US Dollar/Turkish Lira) or EUR/SEK (Euro/Swedish Krona).

Exotic currency pairs in the Forex market typically involve currencies from smaller or emerging market economies. These pairs are less frequently traded compared to major currency pairs and may exhibit higher volatility and wider spreads.

Base and Quote Currency

In the foreign exchange (Forex) market, currency pairs are quoted in terms of two currencies. When trading a currency pair, traders speculate on the future direction of the exchange rate between the base and quote currencies. Depending on their analysis and market expectations, traders will buy (go long) or sell (go short) a currency pair.

- If the EUR/USD exchange rate is 1.20, it means 1 Euro (base currency) is equivalent to 1.20 US Dollars (quote currency).

- Conversely, if the exchange rate is 0.85, it means 1 US Dollar (quote currency) can buy 0.85 Euros (base currency).

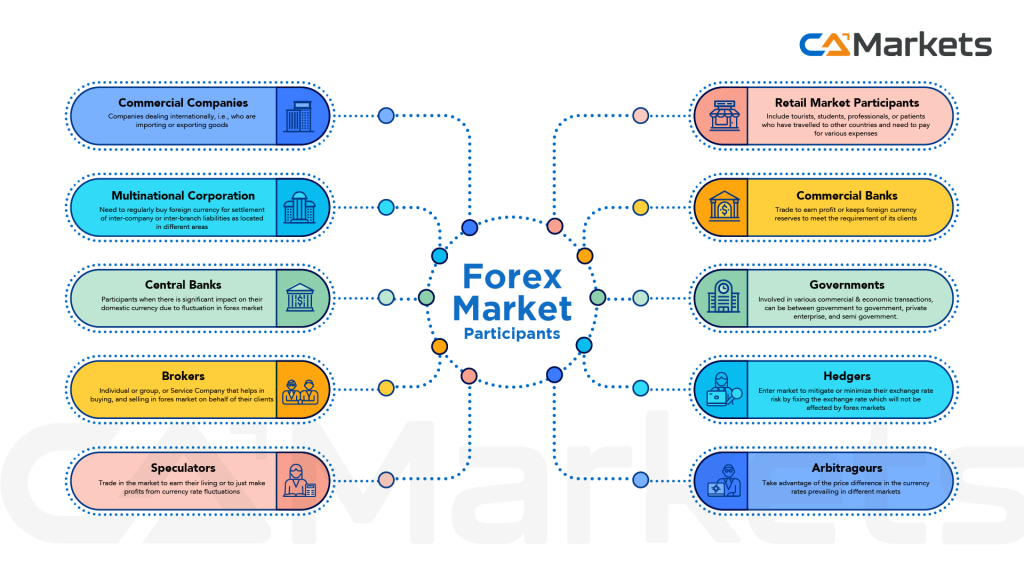

Market Participants

Participants in the Forex market include central banks, commercial banks, financial institutions, corporations engaged in international trade, hedge funds, investment management firms, and individual retail traders. Each participant engages in Forex trading for various reasons, including hedging against currency risk, speculation, or conducting international business transactions.

Trading Instruments

Forex trading is facilitated through trading platforms provided by brokers, for examples: MT4 and MT5. These platforms offer tools for market analysis, real-time price quotes, charting, order execution, and risk management. Traders can execute trades in different sizes, from standard lots (100,000 units of the base currency) to mini lots (10,000 units) or micro lots (1,000 units), depending on their trading capital and risk tolerance.

Forex trading involves various instruments that traders use to speculate on currency exchange rate movements and manage their exposure to currency risk. Examples of the instruments used in Forex trading include Spot Forex Market, Forward Contracts, Futures Contracts, Options Contracts, Contracts for Difference (CFDs), Binary Option etc.

Overall, the Forex market’s primary function is to facilitate the exchange of currencies for global commerce and investment purposes. Its high liquidity, continuous operation, and accessibility make it a vital component of the global financial system.