The Forex market offers a variety of financial instruments that cater to different trading styles and objectives. Among the financial instruments, the most popular ones are retail forex, spot FX, currency futures, currency options, currency exchange-traded funds (or ETFs), forex CFDs, and forex spread betting.

We will focus on Contract of Difference here.

Forex CFD

A contract for difference (CFD) is a derivative financial product that enables traders to speculate on the price movements of underlying assets without owning them. Instead of purchasing the asset outright, traders enter into an agreement with a broker to exchange the difference in price of the asset from the contract’s opening to its closing. CFDs cover a wide range of assets including stocks, indices, commodities, currencies, and cryptocurrencies. Traders can go long (buy) if they anticipate the price will rise or go short (sell) if they expect it to fall. This flexibility allows for potential profit in both rising and falling markets. However, CFD trading involves leverage, which amplifies both potential gains and losses, making risk management crucial. It also requires traders to deposit a margin with the broker to open and maintain positions and entails market risks due to price volatility and the speculative nature of the transactions.

Leverage

Leverage in CFD (Contract for Difference) trading allows traders to control a larger position in the market with a smaller amount of capital. It is a key feature that amplifies both potential profits and losses.

Leverage is expressed as a ratio (e.g., 10:1, 50:1, 100:1) and determines how much a trader can borrow from the broker to open and maintain a position. For example, with a leverage ratio of 50:1, a trader can control a position worth $50 for every $1 of their own capital.

Benefits of using leverage:

- Increased Buying Power: Leverage allows traders to enter larger positions than their initial capital would permit, potentially magnifying profits when trades move in their favor.

- Diversification: Traders can spread their capital across multiple positions, accessing various markets and assets simultaneously.

Risk of using leverage:

- Potential for Higher Returns: Leverage enables traders to amplify gains, but it also increases the risk of significant losses.

- Margin Requirements: To open a leveraged position, traders must deposit a percentage of the total trade value (margin). If losses exceed the margin deposited, traders may face a margin call or liquidation of their position.

Margin

Margin in Forex CFD trading is pivotal, dictating the size of positions traders can open and maintain. When initiating a trade, traders must deposit an initial margin, a percentage of the total trade value, with their broker. This deposit ensures sufficient funds are available to cover potential losses from adverse price movements.

Additionally, a maintenance margin exists to sustain open positions; if account balances dip below this level due to losses, traders may face a margin call requiring additional funds to meet requirements.

Example of Margin Calculation:

Let’s say a trader wants to open a position in EUR/USD with a contract size of 100,000 units (standard lot). The current exchange rate is 1.2000, meaning the trader needs to buy €100,000 against USD.

- If the broker requires a margin of 1% (leverage ratio of 100:1), the trader needs to deposit 1% of €100,000, which is €1,000.

- With a leverage ratio of 100:1, the trader controls €100,000 with a €1,000 margin deposit.

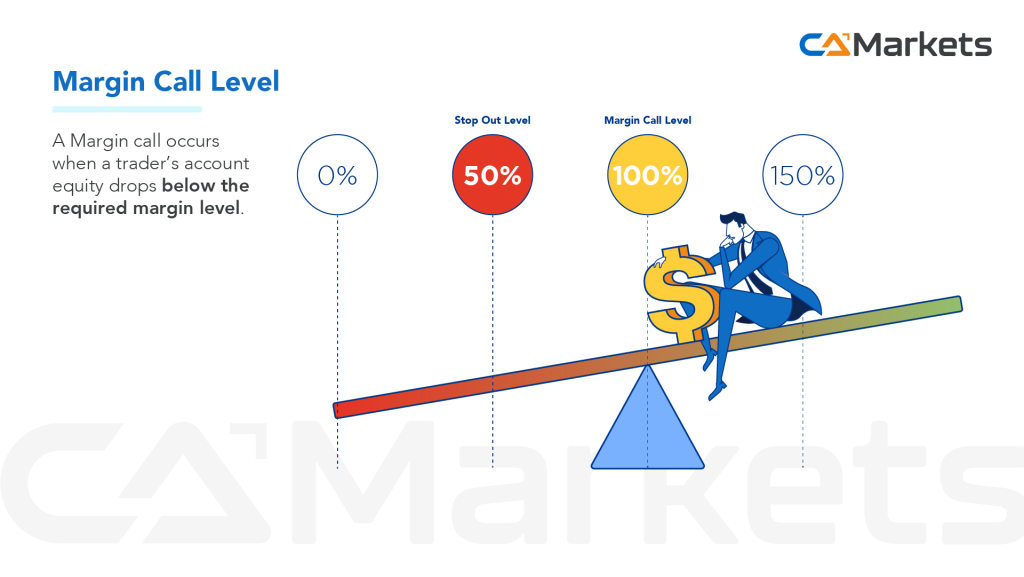

Margin Call

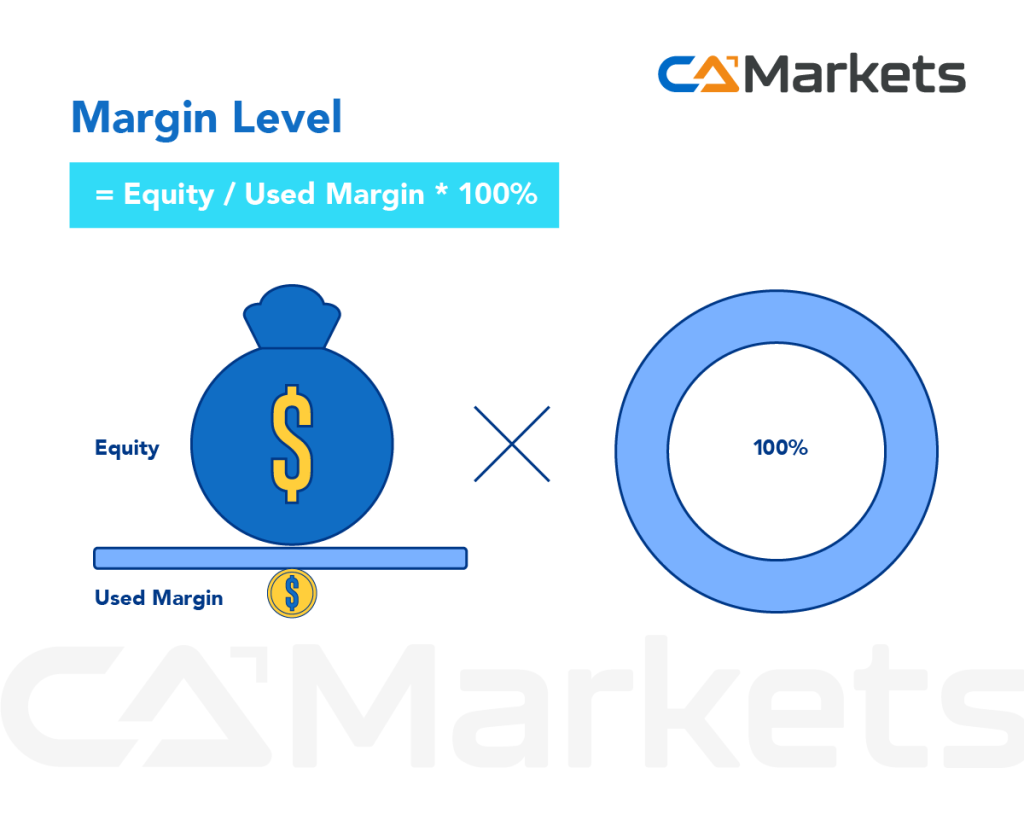

In Forex CFD trading, a margin call occurs when a trader’s account equity drops below the required margin level to maintain open positions. Account equity is the balance of funds in the trading account, including unrealized profits and losses. The margin level, expressed as a percentage, reflects the ratio of equity to used margin. If losses erode the account equity close to or below the maintenance margin level, the broker issues a margin call.

This notification prompts the trader to deposit additional funds into the account to meet the margin requirement. Failure to meet the margin call may result in the broker partially or fully liquidating the trader’s positions to mitigate further losses.